AvaTrade Review

- Trading with AvaTrade - Immediate Advantages and Disadvantages

- Overview

- Inside AvaTrade - What You Need to Know Before You Trade

- Starting with just 100 USD

- Deposit and Withdrawal

- AvaTrade Key Facts Summary

- Fees, Spreads, and Commission

- Leverage and Margin

- Bonus Offers and Promotions

- AvaTrade VIP Services

- AvaTrade - From Dublin to Dubai

- Safety and Security

- What Makes AvaTrade a Cut Above the Rest?

- AvaProtect™

- Versatile Account Options Explained

- AvaTrade Account Verification Process

- Demo Account

- Trading Platforms and Tools

- Which Markets Can You Trade?

- AvaTrade Trading Instruments

- Educational Resources

- AvaTrade Awards and Recognition

- Partnerships, Rebates, and Affiliate Options

- Global Customer Support

- AvaTrade vs Exness vs FBS - AvaTrade Compared

- Insights from Real Traders

- Who Should Trade with AvaTrade?

- Common Complaints About AvaTrade

- What Everyone’s Asking about AvaTrade

- Customer Reviews and Trust Scores

- Discussions and Forums about AvaTrade

- Employee Overview of Working for AvaTrade

- Pros and Cons

- In Conclusion

AvaTrade is a reliable and well-regulated Forex broker known for its competitive trading fees. They provide a user-friendly social copy trading platform, excellent customer support, and boast a trust score of 97 out of 99.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Trading with AvaTrade – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Regulated in multiple top-tier jurisdictions. | Fixed spreads may not suit scalpers. |

| Offers AvaProtect™ for trade loss protection. | U.S. traders are not accepted. |

| AvaSocial allows easy social/copy trading. | Limited cryptocurrency options on Islamic accounts. |

| Low minimum deposit of $100 to start trading. | MT4/MT5 customization options could be broader. |

| Fast withdrawals with no deposit fees. | Inactivity fees apply after 3 months. |

| Strong educational resources via AvaAcademy. | Bonus offers limited to specific regions or conditions. |

Overview

Founded in 2006, AvaTrade is a globally regulated broker offering diverse trading instruments and robust platform options. Moreover, it’s well-regarded for its strong focus on trader education, security tools like AvaProtect, and accessible features. Altogether, these elements make AvaTrade a dependable option for beginners and experienced traders alike.

Frequently Asked Questions

What trading platforms are available at AvaTrade?

AvaTrade offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and its own AvaTradeGO app. In addition, traders can access these platforms on desktop or mobile, ensuring a smooth experience whether they trade manually or use automated strategies. Overall, AvaTrade’s platform range suits diverse trading styles and needs.

Is AvaTrade a good choice for beginner traders?

Yes, AvaTrade is ideal for beginners. Furthermore, it offers free educational videos, webinars, and articles, along with dedicated Account Manager support to help new traders navigate the platforms and begin trading with confidence.

Our Insights

AvaTrade is a top-tier broker that combines global regulation, user-friendly platforms, and effective trader protection tools. Additionally, it’s well-suited for both beginners and experienced traders, thanks to its robust educational resources and innovative features, such as AvaProtect.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Inside AvaTrade – What You Need to Know Before You Trade

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Starting with just 100 USD

AvaTrade keeps online trading accessible by requiring just a 100 USD minimum deposit for Retail and Islamic accounts. This low entry point lets beginners and budget-focused traders enter global markets confidently. By lowering the barrier, AvaTrade helps new traders get started without compromising on service quality.

Frequently Asked Questions

What is the minimum deposit for an AvaTrade account?

AvaTrade’s minimum deposit starts at $100 for both Retail and Islamic accounts, making it easy for new traders to begin exploring the markets without a high upfront investment.

Are there any account types that don’t require a deposit?

Yes, the Demo Account is entirely free. It allows traders to practice with virtual funds and gain real-market experience without making a financial commitment or risking real capital.

Our Insights

AvaTrade’s low minimum deposit shows its dedication to inclusivity and flexible access. Whether you’re trying trading for the first time or upgrading to a more advanced setup, AvaTrade removes financial hurdles, making it easier for anyone to start and grow their trading experience with confidence.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

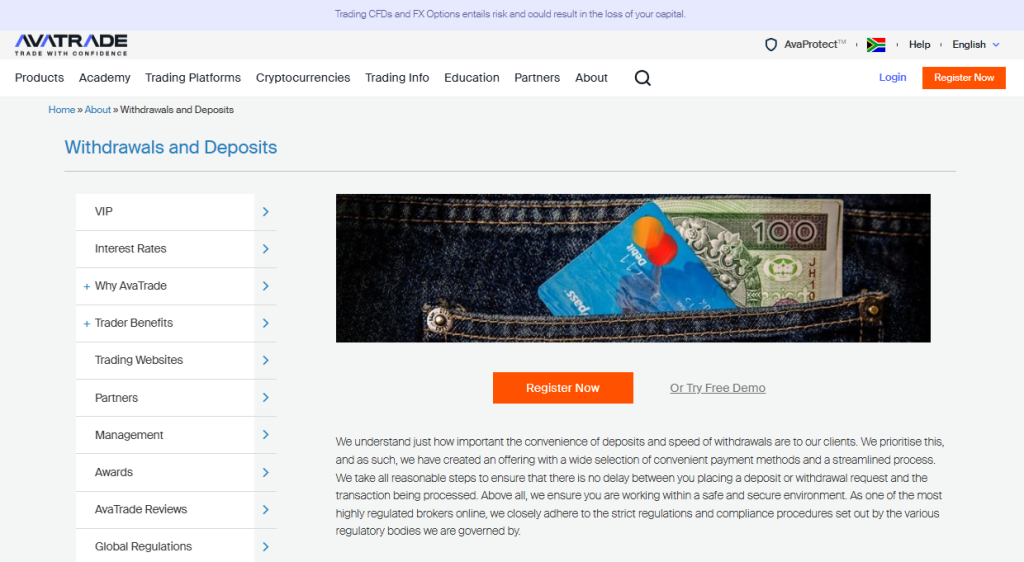

Deposit and Withdrawal

AvaTrade supports a range of deposit and withdrawal methods, including cards, wire transfers, e-wallets, and crypto. The platform ensures a smooth and secure experience, with most transactions processed efficiently and without added broker fees.

| Feature | Details |

| Deposit Methods | Bank wire credit/debit cards e-wallets crypto |

| Withdrawal Methods | Same as deposit methods |

| Processing Time | Typically 24–48 hours (varies by method) |

| Broker Fees | None (third-party fees may apply) |

| User Experience | Simple, secure, and intuitive interface |

Frequently Asked Questions

What methods can I use to deposit funds into my AvaTrade account?

AvaTrade allows deposits via bank wire transfers, credit/debit cards, crypto wallets, and e-wallets. Simply log into your account, go to the deposit section, select your method, and follow the platform’s clear step-by-step instructions.

How do I make a deposit using Bank Wire Transfer?

To deposit via bank wire, log into your AvaTrade account, select “Deposit,” choose “Bank Wire Transfer,” and input your desired amount and currency. Enter your banking details, confirm the transfer, and follow any additional prompts provided.

Our Insights

AvaTrade offers a smooth and flexible deposit/withdrawal process with multiple payment options. Most transactions are processed promptly, and the broker does not impose fees. Furthermore, it is a user-friendly setup, particularly suitable for traders who value fast and secure fund access.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaTrade Key Facts Summary

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Fees, Spreads, and Commission

AvaTrade’s pricing model is built for clarity and fairness. With commission-free trading, fixed spreads, and no deposit or withdrawal fees, traders benefit from a transparent structure. However, overnight and inactivity charges may still apply based on account usage.

| Fee Type | Details |

| Spreads (EUR/USD) | ~0.9 pips (fixed) |

| Stock CFD Spreads | ~0.13% |

| Commodity Spreads | Vary by market (e.g., crude oil, gold) |

| Commissions | None (included in spreads) |

| Overnight Fees | Variable by asset and position type |

| Deposit Fees | None |

| Withdrawal Fees | None |

| Inactivity Fees | $50/month after 3 months; $100/year after 1 year |

| Currency Conversion | Applies if deposit currency ≠ account base currency |

Frequently Asked Questions

Are there any hidden fees in AvaTrade’s trading structure?

No, AvaTrade maintains full transparency. Trading fees are included in fixed spreads, with no hidden commissions. Any extra charges, such as overnight or inactivity fees, are disclosed clearly, giving traders confidence in their cost expectations.

What are AvaTrade’s average spreads?

Spreads differ by asset. EUR/USD averages 0.9 pips, stock CFDs around 0.13%, and commodities like crude oil or gold vary based on market factors. These fixed spreads reflect the broker’s fee structure without extra commission costs.

Our Insights

AvaTrade offers one of the more transparent fee models in the industry. Fixed spreads, zero deposit/withdrawal fees, and no commissions in key regions make it cost-effective, though traders should be mindful of swap rates and inactivity charges.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Leverage and Margin

AvaTrade provides traders with leverage to magnify market exposure, offering ratios like 1:30 depending on asset type and region. While this boosts profit potential, it also heightens risk, making informed use and strong risk management essential.

| Feature | Details |

| Max Leverage | Up to 1:30 (retail clients, varies by region) |

| Asset-Specific Leverage | Varies (e.g., forex, indices, crypto) |

| Margin Requirement | Typically starts from 3.33% |

| Regulation Impact | Leverage limits vary based on regulatory region |

Frequently Asked Questions

What is leverage, and how does it work at AvaTrade?

Leverage at AvaTrade enables traders to control larger positions with smaller capital. For instance, a 1:30 ratio means $1,000 controls $30,000. While this can enhance profits, it also increases potential losses, so caution is advised.

How is the leverage ratio determined at AvaTrade?

AvaTrade’s leverage depends on the asset and jurisdiction. Regulatory bodies cap maximum leverage – often 1:30 for forex in Europe – while commodities, indices, or crypto may have different limits. Always check platform settings based on your region.

Our Insights

AvaTrade offers competitive leverage options with clear margin requirements. It suits both retail and experienced traders, but effective use requires discipline and risk awareness. Educational resources help newcomers understand and manage leveraged positions responsibly.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

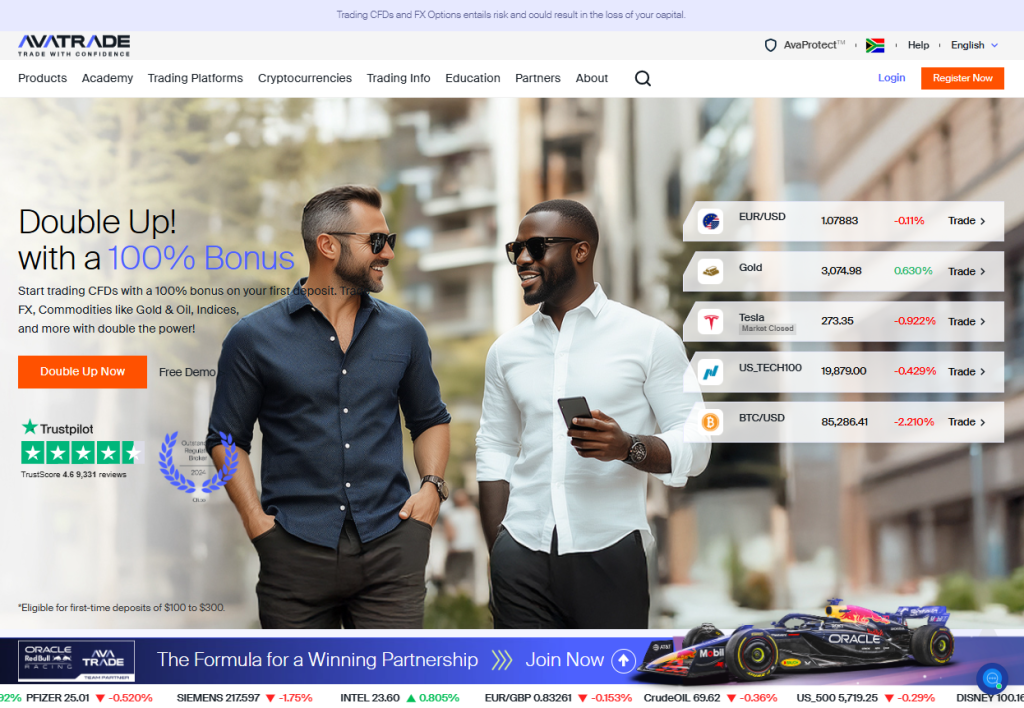

Bonus Offers and Promotions

AvaTrade’s “Double Up!” promotion gives new traders a 100% bonus on first deposits between $100 and $300. This offer instantly doubles your trading power, allowing access to Forex, commodities, and indices with enhanced leverage from the start.

*Please Note – This offer is only available to Forex Traders in South Africa.

Frequently Asked Questions

Who is eligible for the 100% bonus?

The “Double Up!” bonus is available exclusively to first-time depositors. To qualify, users must make an initial deposit between $100 and $300, which will then be matched by AvaTrade to double the trading capital.

How does the bonus work?

When you deposit between $100 and $300 for the first time, AvaTrade matches that amount with a 100% bonus. For example, depositing $250 gives you a total of $500 in trading funds to use on the platform.

Our Insights

AvaTrade’s “Double Up!” bonus is a great incentive for new traders to start with enhanced capital. It offers access to major markets with increased leverage, but comes with conditions, so understanding the fine print is essential.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaTrade VIP Services

AvaTrade’s Premium Membership offers elite traders exceptional value through superior service, exclusive tools, and enhanced trading conditions. With no application required, traders are automatically elevated based on their activity, making advancement seamless and rewarding.

| Tier | Deposit Amount | Trading Volume | Key Benefits |

| Silver | $10,000 | $30M | VIP support AvaGuide live chat queue priority |

| Gold | $25,000 | $100M | Personal relationship manager expedited withdrawals |

| Platinum | $50,000 | $250M | Trading Central insights, volatility alerts, AvaProtect |

| Diamond | $150,000 | $600M | VIP hospitality, direct phone support, exclusive event invitations |

Perks are cumulative and remain active through the next calendar year once a tier is reached.

Frequently Asked Questions

How can I become an AvaTrade Premium Member?

No application is needed! AvaTrade automatically assigns Premium tiers based on your annual deposits or trading volume. Once qualified, your status remains active for the entire following calendar year.

What benefits do Premium Members receive?

Premium Members enjoy VIP support, speedy withdrawals, Trading Central insights, special trading conditions, and exclusive access to events, tools, and market intelligence—all designed to elevate your trading experience.

Our Insights

AvaTrade’s Premium Membership offers a comprehensive package for serious traders, combining advanced tools and VIP treatment. With perks that scale as you trade more, it’s a smart pathway to a more powerful trading journey.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

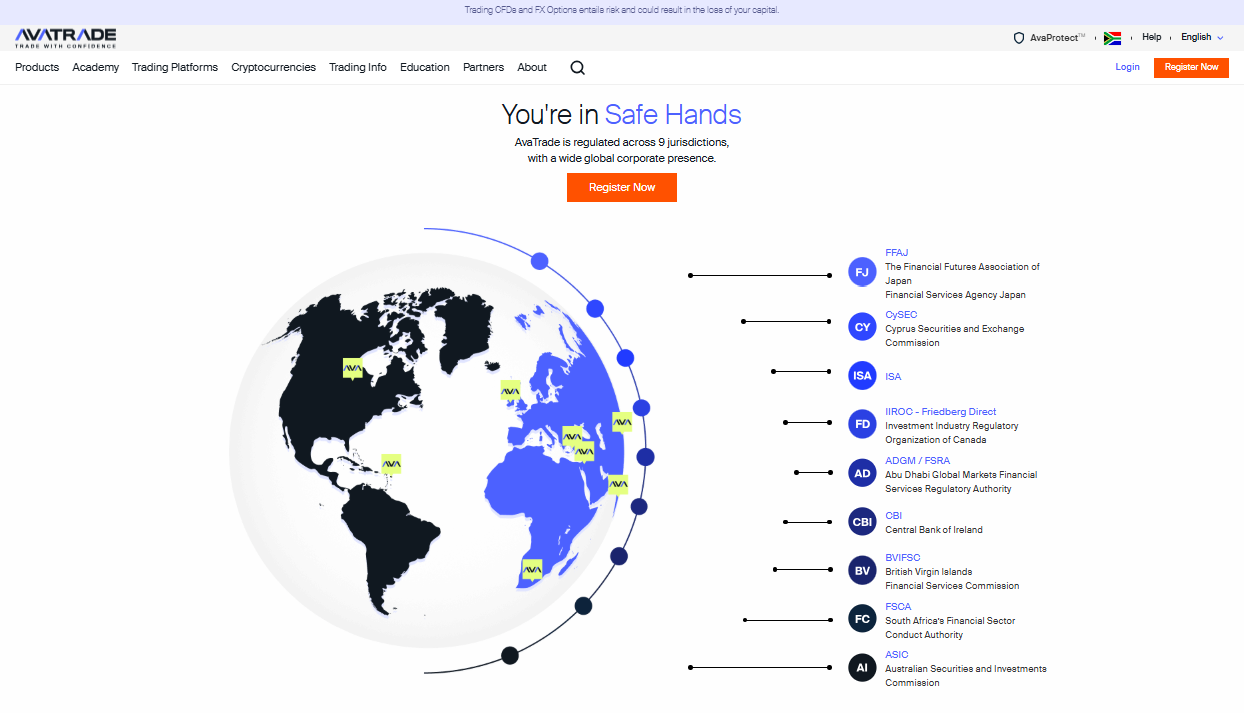

AvaTrade – From Dublin to Dubai

AvaTrade is a globally regulated investment firm, licensed across multiple jurisdictions – including the EU, Australia, Japan, South Africa, the Middle East, and more. As a result, traders benefit from strict compliance, secure fund handling, and region-specific investor protection frameworks.

Frequently Asked Questions

In which countries is AvaTrade regulated?

AvaTrade is licensed in Ireland, Cyprus, Australia, Japan, South Africa, India, the UAE, the British Virgin Islands, Poland, and Israel. Its global footprint ensures traders receive strong legal protections tailored to their local financial regulations.

Can I trade with AvaTrade from anywhere in the world?

While AvaTrade operates globally, access may vary based on your country’s laws. Moreover, residents of regulated regions enjoy full access to AvaTrade’s products, including stocks, cryptos, indices, and more, within compliant, jurisdiction-specific frameworks.

Our Insights

With a presence in key global markets and oversight by top-tier regulators like ASIC, FSCA, and CySEC, AvaTrade stands out as a safe, transparent broker. Its global regulation helps ensure a consistent, trustworthy trading experience for clients worldwide.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Safety and Security

AvaTrade is a globally licensed broker known for its strict regulatory compliance and robust trader protection. It offers secure access to CFDs, Forex, crypto, and more, backed by financial transparency and fund segregation across key international jurisdictions.

| Broker | AvaTrade |

| Regulation | 🇮🇪 CBI 🇻🇬 BVI 🇲🇺 FSC 🇦🇺 ASIC 🇿🇦 FSCA 🇯🇵 JFSA 🇯🇵 FFAJ |

| Fund Security | Client funds held in segregated accounts |

| Compliance Standards | High-level adherence to international financial regulations |

| Markets Offered | CFDs Forex Stocks ETFs Bonds Cryptos Indices |

| Global Reach | Operates in most regions worldwide with localized support |

| Transparency | Regular financial reporting and regulatory disclosures |

| Ideal For | Traders seeking a secure and regulated trading environment |

Frequently Asked Questions

Is AvaTrade regulated?

Yes, AvaTrade is regulated in multiple regions, including the EU, Australia, Japan, South Africa, the Middle East, and Israel. These licenses help ensure a transparent, compliant, and safe trading environment for its clients worldwide.

What markets can I trade with AvaTrade?

AvaTrade supports trading in CFDs, Forex, stocks, ETFs, bonds, cryptocurrencies, and indices. This broad selection enables strategic diversification, catering to traders with diverse goals and risk appetites.

Our Insights

AvaTrade delivers a highly secure and compliant trading experience backed by multi-jurisdictional regulation. With segregated funds, transparency, and access to diverse instruments, it’s a reliable broker for those prioritising safety in global markets.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

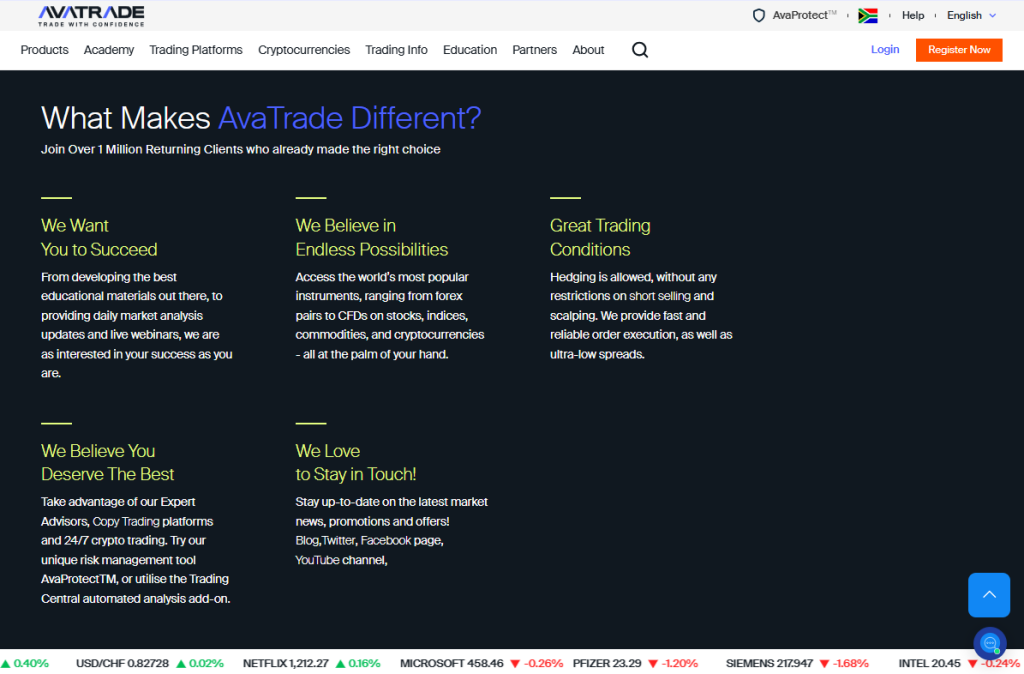

What Makes AvaTrade a Cut Above the Rest?

AvaTrade stands out with its user-friendly platforms, competitive spreads, and strong regulatory backing. Features like AvaProtect™, fast withdrawals, and top-tier customer support give traders confidence, while educational tools and copy trading enhance both beginner and pro experiences.

Frequently Asked Questions

Is AvaTrade suitable for beginners?

Yes, AvaTrade is ideal for beginners thanks to its intuitive platforms, demo account, and rich educational content. Tools like AvaSocial also allow users to follow experienced traders and learn strategies in real time.

How secure is trading with AvaTrade?

AvaTrade is highly secure, regulated by multiple global authorities, including ASIC, FSCA, and CySEC. Features like AvaProtect™ further enhance trader safety by offering loss protection on selected trades.

Our Insights

AvaTrade delivers a powerful yet accessible trading experience. With strong regulation, intuitive tools, and innovative features like AvaProtect™, it’s a top choice for both beginners and seasoned traders seeking reliability, education, and consistent support.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaProtect™

AvaProtect™ is AvaTrade’s exclusive risk management tool that insures trades against losses for a limited time. Available on AvaTradeGO and WebTrader, it lets traders protect FX, gold, and silver positions up to $1 million.

| Feature | AvaProtect™ |

| Function | Loss protection for specific trades |

| Available On | AvaTradeGO and WebTrader platforms |

| Protected Instruments | Forex (FX) Gold Silver |

| Maximum Coverage | Up to $1,000,000 per protected trade |

| Protection Periods | 1h, 3h, 6h, 12h, 1-day, 2-day (expires 10 AM NY time) |

| Cost Structure | Premium based on volatility, asset, and duration |

| Early Closure | Still eligible for reimbursement if closed at a loss |

| Ideal For | Traders seeking to limit short-term risk during volatile conditions |

Frequently Asked Questions

Does AvaProtect™ offer protection when markets turn against me?

Yes. AvaProtect™ ensures your trade during a selected timeframe. If the market moves against your position, AvaTrade reimburses the loss (excluding the hedging fee) directly to your account at the end of the protection period.

How is the premium for AvaProtect™ calculated?

The AvaProtect™ premium is based on trade size, the protection period, and expected market volatility. The cost is shown upfront and deducted when you activate protection, allowing for full transparency in your risk management.

Our Insights

AvaProtect™ empowers traders to manage risk confidently with short-term loss protection. It’s a standout feature that adds insurance-like coverage to volatile trades, offering flexibility and peace of mind for both new and experienced traders.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Versatile Account Options Explained

AvaTrade accommodates traders at every stage with four main account types: Retail, Islamic, Professional, and Demo. With a low $100 minimum deposit, leverage flexibility, and account-specific features, AvaTrade offers trading environments for beginners to seasoned professionals.

| Account Type | Minimum Deposit | Key Features | Leverage |

| Retail Account | 100 USD | User-friendly tight spreads access to all platforms and assets | Up to 1:30 |

| Islamic Account | 100 USD | Swap-free Sharia-compliant no crypto markup fee instead of interest | Up to 1:30 |

| Professional Account | Varies (criteria) | Higher leverage advanced tools fewer investor protections | Up to 1:400 |

| Demo Account | Free | Virtual balance ($10K–$150K) simulates real market conditions 21-day access | Not applicable |

Frequently Asked Questions

What is the minimum deposit for a Retail Account?

AvaTrade’s Retail Account requires a minimum deposit of only $100, giving both new and experienced traders an affordable entry into the world of online trading across multiple financial instruments and platforms.

Can I trade cryptocurrencies with an Islamic Account?

No, cryptocurrencies are excluded from AvaTrade’s Islamic Account due to Sharia compliance. The account supports trading in forex, commodities, and CFDs, and replaces swap fees with a transparent markup structure.

Our Insights

AvaTrade’s range of account types offers accessible, tailored trading solutions for all levels. Whether you want low-barrier entry, professional-grade features, or Sharia-compliant conditions, AvaTrade’s accounts are designed with flexibility, compliance, and trader development in mind.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaTrade Account Verification Process

To register an account, click the “Open a Real Account” button on the AvaTrade Homepage. Next, follow these steps to complete the process:

1. Step 1: Complete the Online Registration Form.

Enter your email address and create a new password.

2. Step 2: Complete the remainder of the registration form.

Select your country of residence and account type. You may choose between a Retail Demo Account, a Retail Account, and a Professional Account.

3. Step 3: Fill out your personal information

Including your name, birthdate, and address. Verify your account and submit a copy of your ID and proof of residence.

Finally, fund your account. You can fund your account using a credit card, debit card, or bank transfer. Once your account is funded, you may begin trading on the AvaTrade platform.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Demo Account

AvaTrade provides a practical platform for mastering trading. Its unlimited demo account lets beginners explore MT4, MT5, WebTrader, and the AvaTrade App without risking real funds. Features like stop-loss, take profit, and AvaProtect allow safe strategy testing while building confidence and trading skills.

| Feature | Description | Platforms | Regulation |

| Demo Account | Unlimited practice with virtual funds | MT4 MT5 WebTrader AvaTrade App | 🇮🇪 FCA 🇿🇦 FSCA 🇧🇻 BVI and more |

| Risk Management | Stop-loss Take profit AvaProtect | All platforms | Global compliance |

| Learning | Strategy testing and backtesting | All platforms | N/A |

| Copy Trading | AvaSocial DupliTrade | All platforms | N/A |

Frequently Asked Questions

How do I open an AvaTrade demo account?

Opening a demo account is simple. First, sign up on the AvaTrade platform. Next, claim your free demo account. Finally, start learning and practicing with MT4, MT5, WebTrader, or the AvaTrade App, simulating real trades without committing actual funds.

What tools can I use to protect my demo trades?

AvaTrade provides stop-loss orders to limit losses and take profits to secure gains automatically. AvaProtect gives unique protection for individual trades against adverse movements for a set duration, helping you safely test strategies and gain practical trading experience.

Our Insights

AvaTrade’s demo account delivers a risk-free, immersive environment for practicing and learning trading. With advanced tools, multiple platforms, and strong regulation, it combines safety, flexibility, and educational value, making it ideal for both beginners and traders preparing for real trading.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

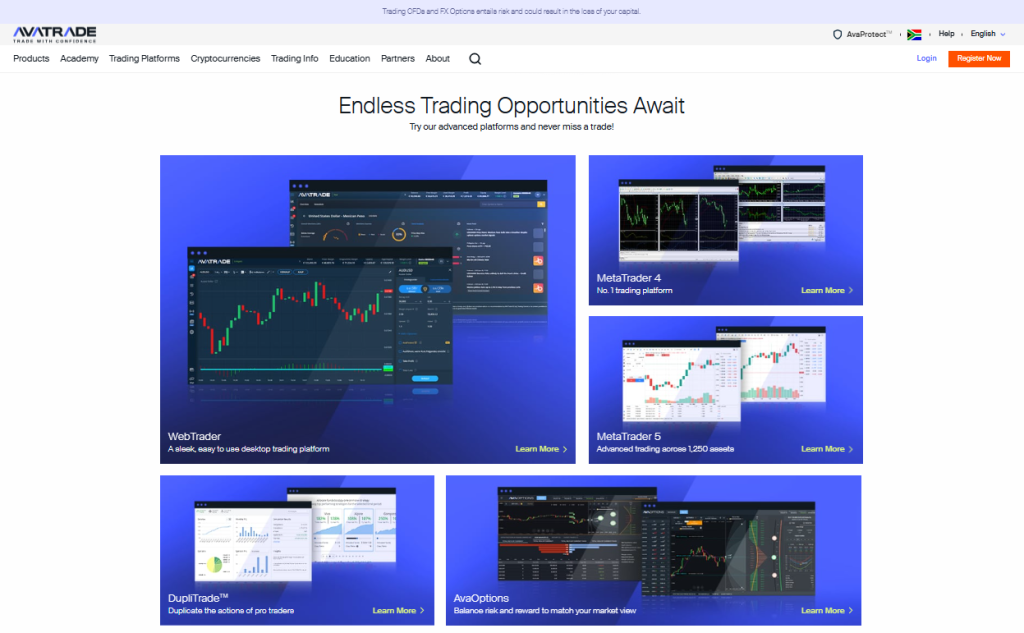

Trading Platforms and Tools

AvaTrade offers a range of trading platforms to suit different trader preferences:

MetaTrader 4 and 5

MetaTrader 4 and 5 are powerful, industry-leading platforms offering advanced charting tools, algorithmic trading capabilities, and real-time market analysis.

MT5 further expands access to equities, commodities, and indices, providing a comprehensive solution for multi-asset trading strategies.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

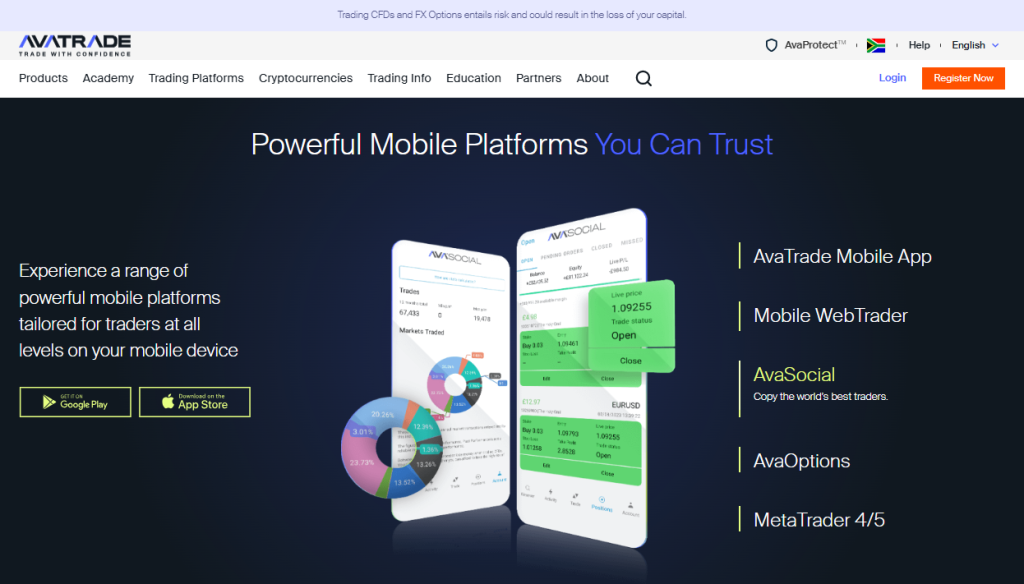

AvaTradeGO

AvaTrade’s award-winning mobile app delivers real-time market feeds, social trading trends, and seamless integration of

AvaProtect™ – a unique risk management tool – allows traders to monitor positions, execute trades, and manage risk effectively while on the go.

AvaTrade Mobile Trading Experience

The AvaTradeGO app enhances flexibility for traders who prefer to manage their accounts on the go.

Its sleek design and advanced features make mobile trading efficient and intuitive.

Key Mobile App Features:

- Access to real-time quotes and one-tap order execution.

- Seamless integration with AvaProtect™ for loss protection.

- Custom watchlists and advanced charting with multiple timeframes.

- Compatible with both iOS and Android devices.

- Push notifications for price alerts and market updates.

AvaTradeGO and AvaSocial bring a professional-grade experience to mobile traders who value convenience without sacrificing analytical tools.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaSocial

AvaSocial is an intuitive social trading app that enables users to copy strategies from experienced traders, monitor their performance in real-time, and engage directly with the trading community, making it easier to learn, connect, and grow as a trader.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

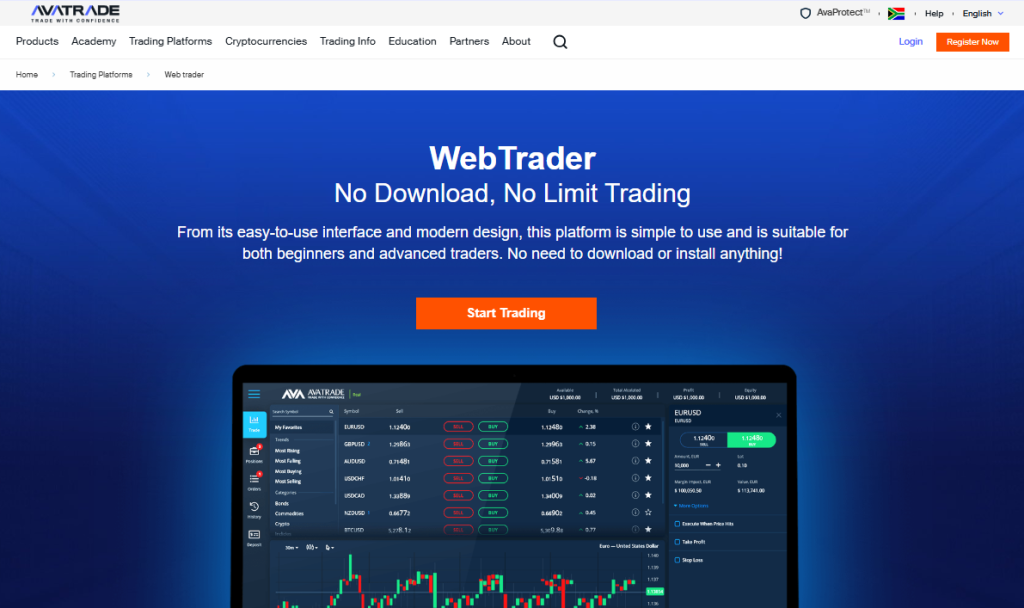

AvaTrade Web

AvaTrade Web is a secure, browser-based trading platform offering advanced charting tools, real-time market news, and a seamless user interface. Designed for traders of all experience levels, it provides reliable access to global markets without requiring downloads.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

DupliTrade

DupliTrade is an automated trading platform that allows users to replicate the strategies of vetted expert traders. Ideal for beginners or those preferring a hands-off approach, it offers transparency, performance tracking, and seamless integration with AvaTrade accounts.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaOptions

AvaOptions is a dedicated platform for options trading, combining powerful strategy visualization with intuitive risk management tools. It allows traders to customize and analyze strategies across various market scenarios, making it ideal for both novice and advanced options traders.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaFutures

AvaFutures is a specialized platform tailored for futures trading, featuring commission-free trades and a user-friendly interface. It also provides comprehensive educational resources, making it suitable for traders of all experience levels looking to explore futures markets confidently.

Frequently Asked Questions

What are the main differences between MetaTrader 4 (MT4) and MetaTrader 5 (MT5)?

MT4 is known for its user-friendly interface, automated trading, and charting tools. MT5 offers enhanced features, including more timeframes, an economic calendar, faster processing, and support for additional asset classes like equities, commodities, and indices.

How does AvaSocial help improve my trading?

AvaSocial connects you with expert traders to copy their strategies, making it easier for beginners to learn and experienced traders to save time. You can diversify your portfolio, track performance, and interact with other traders, all while maintaining full control.

Our Insights

AvaTrade supports all trader levels with platforms like MetaTrader 4/5, AvaTradeGO, AvaSocial, DupliTrade for automation, AvaOptions for options trading, and AvaFutures for futures, offering a complete, user-friendly experience with powerful tools and educational support.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

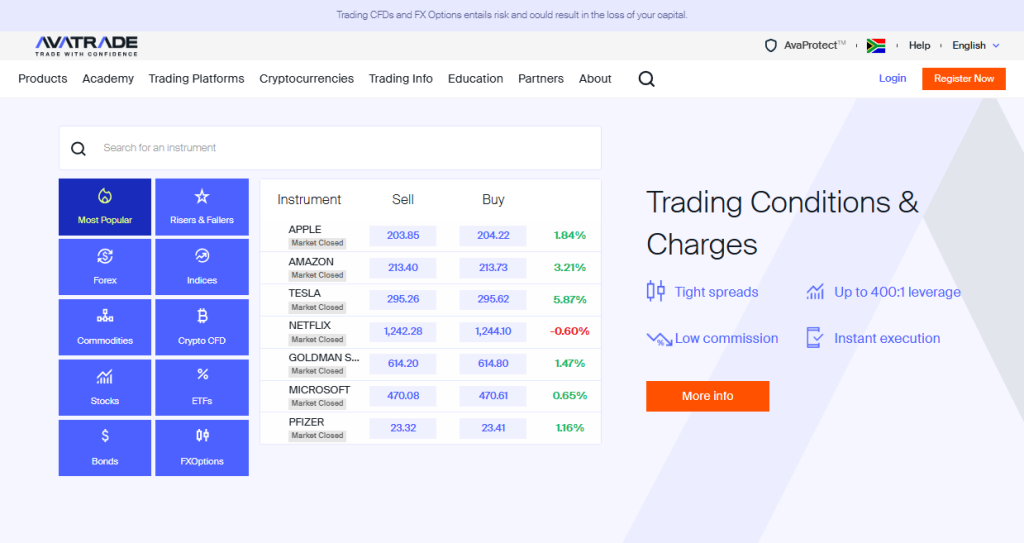

Which Markets Can You Trade?

AvaTrade offers access to 50+ currency pairs, commodities like gold, oil, and natural gas, global indices, stocks, and major cryptocurrencies. It also provides FXOptions, enabling flexible strategies for portfolio diversification and advanced hedging or speculation.

Frequently Asked Questions

What types of currency pairs can I trade with AvaTrade?

AvaTrade offers over 50 currency pairs, including major, minor, and exotic options. This wide selection enables traders to access diverse forex markets and tailor their trading strategies to specific currencies, market conditions, and risk preferences.

Can I trade metals like gold and silver with AvaTrade?

Yes, AvaTrade offers trading access to precious metals like gold and silver. These assets are commonly used as safe-haven investments, helping traders hedge against inflation, market volatility, and broader economic uncertainty during times of financial instability.

Our Insights

AvaTrade offers a wide range of trading instruments to suit different strategies, including flexible options trading and FXOptions – a hybrid product that combines Forex and options trading, allowing for advanced risk management and speculative opportunities across global markets.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaTrade Trading Instruments

AvaTrade provides a broad selection of global markets designed to suit both beginners and experienced traders.

| Asset Type | Details |

| Forex | 50+ currency pairs including majors, minors, and exotics such as EUR/USD, GBP/JPY, and USD/ZAR. |

| Stocks | Trade top equities like Apple, Tesla, Amazon, and Meta via CFDs. |

| Indices | Access leading global indices including NASDAQ, FTSE 100, S&P 500, and DAX. |

| Commodities | Diversify with gold, silver, crude oil, natural gas, and agricultural CFDs. |

| Cryptocurrencies | Trade BTC, ETH, XRP, ADA, and LTC without owning the asset directly. |

| ETFs Bonds | Available through CFDs for portfolio diversification. |

| Options | Advanced traders can access AvaOptions for customizable trading strategies. |

AvaTrade’s range of instruments allows traders to pursue opportunities across multiple sectors from one account.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Educational Resources

AvaTrade offers a detailed glossary of market terms to help traders understand key terminology. Additional resources include the AvaAcademy, Trader’s Blog, video lessons, and guides. Traders also receive fresh trading ideas to inspire strategy and improve decision-making.

Ava Academy

AvaAcademy offers free, structured trading education through courses, videos, and quizzes. Covering forex, stocks, crypto, and more, it empowers beginners and advanced traders to enhance skills anytime – on desktop or mobile – with real-time learning and simulator access.

What is AvaAcademy, and who is it for?

AvaAcademy is AvaTrade’s free educational platform designed for traders of all levels. It offers structured courses, interactive quizzes, and practical knowledge to help users understand how, when, and what to trade effectively.

How do I start learning on AvaAcademy?

Simply sign up, choose your skill level and course topic, and begin learning through videos, articles, and quizzes. You’ll gain instant access to financial knowledge across multiple asset classes and trading strategies.

Frequently Asked Questions

What educational resources does AvaTrade offer to traders?

AvaTrade provides a rich selection of educational tools, including a market glossary, Trader’s Blog, video tutorials, guided lessons, and fresh trading ideas. Together, these resources empower users to expand their market knowledge and sharpen their trading strategies effectively.

How can the glossary help me as a trader?

The glossary offers clear definitions of key market terms and trading jargon, helping especially new traders build confidence. In addition, it enhances understanding of trading concepts and improves communication within trading environments for a more informed trading experience.

Our Insights

AvaTrade provides educational resources for traders of all levels, including a detailed glossary to explain market terms and The Trader’s Blog, which offers timely insights, updates, and educational content to support informed trading decisions.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaTrade Awards and Recognition

AvaTrade has consistently earned industry recognition for innovation, reliability, and client satisfaction. Recent Awards Include:

- Best Forex Broker 2023 – Global Finance Awards

- Most Trusted Broker 2022 – Ultimate Fintech Awards

- Best Educational Resources 2022 – International Business Magazine

- Best Fixed Spread Broker 2021 – Forex Expo Dubai

These accolades reflect AvaTrade’s ongoing commitment to transparency, technological advancement, and trader empowerment worldwide.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Partnerships, Rebates, and Affiliate Options

AvaTrade’s affiliate program empowers over 70,000 global partners with lucrative commission models, advanced marketing tools, and timely payouts. Furthermore, with flexible CPA, revenue share, and hybrid options, it’s a standout opportunity for individuals and businesses promoting online trading platforms.

| Program Type | Affiliate/Referral + Rebates |

| Total Partners | 70,000+ across 150+ countries |

| Commission Models | CPA Revenue Share Hybrid |

| Support Provided | Dedicated managers multilingual support 20+ languages |

| Marketing Tools | Banners landing pages tracking links real-time analytics |

| Payout Reliability | On-time consistent payments |

| Total Commissions Paid | Over $250 million |

| Ideal For | Bloggers influencers trading educators site owners |

| Custom Deals | Yes |

Frequently Asked Questions

How does the AvaTrade affiliate program work?

AvaTrade’s affiliate program lets you earn commissions by referring new traders. You’ll receive access to marketing tools and tracking systems, and get rewarded based on how many clients you introduce and the commission model you choose.

What kind of commissions can I earn as an affiliate?

You can earn through CPA (fixed payouts per client), revenue share (percentage of trading activity), or hybrid models. Moreover, AvaTrade allows partners to tailor their earning structure based on their audience and marketing performance.

Our Insights

AvaTrade’s affiliate and rebate program delivers strong earning potential through flexible commission models, world-class support, and global reach. It’s a smart choice for individuals or businesses looking to monetize financial traffic in a professional, fully supported environment.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

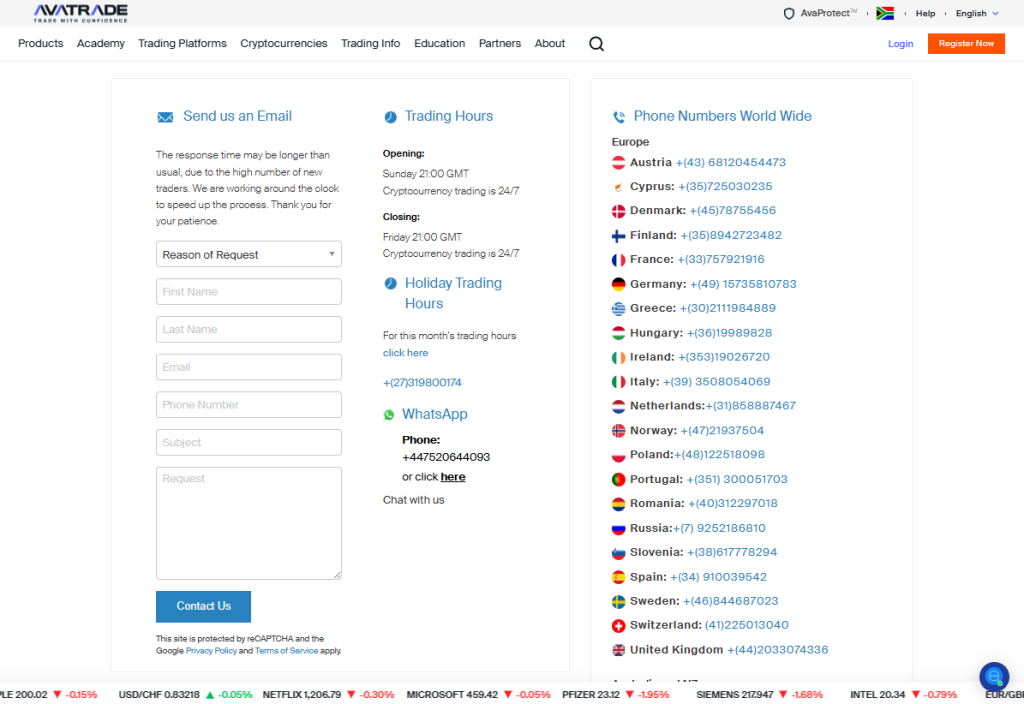

Global Customer Support

AvaTrade provides global customer support through email, WhatsApp, and local phone numbers for different regions. Nevertheless, while high demand can sometimes cause slight delays, the support team stays committed to helping traders at every level. Their multiple contact channels ensure clients get timely help when they need it most.

| Contact Method | Details |

| Contact form with name, email, phone, subject, and request fields |

|

| +44 7520 644093 Chat instantly |

|

| Phone Support | Available worldwide Specific numbers by region |

| reCAPTCHA | Site is protected by Google reCAPTCHA |

| Trading Opens | Sunday 21:00 GMT |

| Trading Closes | Friday 21:00 GMT |

| Crypto Trading | 24/7 Availability |

| Holiday Hours | Vary monthly Check site updates |

Frequently Asked Questions

Why is my email response taking longer than expected?

Due to a high volume of inquiries from new traders, response times may be slightly delayed; however, the support team is actively working around the clock to respond to every message as promptly as possible.

When can I access trading support?

Support is available throughout trading hours: from Sunday 21:00 GMT to Friday 21:00 GMT. Additionally, cryptocurrency traders enjoy 24/7 access. WhatsApp and global phone lines offer continuous assistance.

Our Insights

Despite occasional delays, the platform’s commitment to 24/7 cryptocurrency trading and broad international support coverage highlights its dedication to responsive, global customer service.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

AvaTrade vs Exness vs FBS – AvaTrade Compared

Insights from Real Traders

⭐⭐⭐⭐

Can AvaTrade be trusted? – Yes! AvaTrade has transformed my trading! The app is user-friendly, making it easy to trade anywhere. Leverage options boost my profits, and AvaProtect™ gives peace of mind. Great support and helpful education make it my top choice. –

Emma

⭐⭐⭐⭐⭐

Trading with AvaTrade has been fantastic. MetaTrader 4 and 5 offer powerful and reliable tools, and the range of instruments lets me diversify easily. Fast deposits, reliable withdrawals, and great support make AvaTrade a top-tier, trustworthy broker. –

Michael

⭐⭐⭐

As a beginner, AvaTrade has been a legit choice! The platform is intuitive, and the demo account helped me build confidence. AvaSocial is a game-changer – learning from experts has boosted my skills and returns. Highly recommended! –

Sophie

User Reviews and Experiences

| Platform | Rating (5) | Number of Reviews | Notable Comments |

| Google Play | 4.3 | 10.7K+ | Mixed feedback; some users report app slowness and buffering issues. |

| App Store | 4.0 | Not specified | Users praise the app's professionalism and ease of use. |

| App Store | 2.1 | 10 | Lower ratings in Switzerland; specific concerns not detailed. |

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Who Should Trade with AvaTrade?

AvaTrade is ideal for traders seeking a safe, regulated environment combined with modern tools and easy access to diverse markets. Best Suited For:

- Beginners – thanks to AvaAcademy, fixed spreads, and easy-to-use platforms.

- Intermediate Traders – who benefit from social trading via AvaSocial and AvaProtect™.

- Professionals – who require multiple platforms, advanced analysis tools, and diverse instruments.

- Islamic Traders – with swap-free account options available.

- Global Traders – supported in multiple regions under top-tier regulation.

AvaTrade’s wide appeal lies in its balance of accessibility, security, and versatility across asset classes and trading styles.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Common Complaints About AvaTrade

| Complaint | Details |

| Withdrawal Delays | Slow processing reversals unclear reasons |

| Customer Support | Long wait times poor response unresolved issues |

| Aggressive Marketing | Frequent calls messages pushy follow-ups |

| Technical Glitches | Lag chart errors platform outages |

| Account Closures | Sudden restrictions lack of transparency |

What Everyone’s Asking about AvaTrade

Q: What’s the minimum deposit to start trading with AvaTrade? – Julias, Kenya

A: The standard minimum deposit is 100 USD (or equivalent in EUR, GBP, or AUD). However, if you’re using a bank wire, the minimum is usually around $500.

Q: What types of accounts does AvaTrade offer for different traders? – Fatima, UAE

A: AvaTrade provides several account types: Retail (Standard), Professional, Demo for practice, and Islamic (swap-free) accounts for Sharia-compliant trading.

Q: Which trading platforms can I use with AvaTrade? – David, Australia

A: You can trade using MetaTrader 4, MetaTrader 5, AvaTradeGO (mobile app), WebTrader, AvaOptions for options trading, plus DupliTrade and ZuluTrade for copy trading.

Q: How do deposits and withdrawals work with AvaTrade, and how fast are they? – Maria, Spain

A: Deposits via cards are usually instant. E-wallets like Skrill and Neteller process within 24 hours. Bank wires may take 1–7 business days. Withdrawals generally follow the same speed.

Q: Are there any extra fees or hidden charges I should know about? – Ahmed, Egypt

A: AvaTrade has no commissions – only spreads. But be aware of overnight swap fees and inactivity fees (50 USD/month after 3 months of no activity, 100 USD after a year).

Q: How long does it take for AvaTrade to verify my account? – Sophia, South Africa

A: Account verification usually takes between 24 and 48 hours, provided all your documents are clear and meet KYC standards.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Customer Reviews and Trust Scores

AvaTrade receives generally positive feedback from customers across major review platforms, reflecting a strong reputation in trading services.

| Platform | Trust/Rating Score | Total Reviews | Key Highlights |

| Trustpilot | 4.7 / 5 | ~10,469 | Very supportive, customized payment methods |

| TradersUnion | N/A | N/A | Regulated globally, over 300,000 clients, handles 2M+ orders/month |

| N/A | varied posts | Some praise reliability; others allege high spreads or account issues |

Overall, these sources paint a picture of a broker with strong ratings, but also report some cautionary tales.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Discussions and Forums about AvaTrade

Across Reddit and trading communities, users share mixed experiences with AvaTrade, highlighting both positive features and reported concerns.

| Topic | Feedback Summary |

| Platform/fees | Some users note Avatrade spreads aren’t always tight; demo accounts may differ from real ones |

| Customer interaction | Reports of unsolicited follow-up calls after signup; excessive contact for high-value users |

| User trust stories | Some claim account freezing or fund loss; others note consistent payouts |

These discussions underscore the importance of understanding volatility and broker practices before engaging.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Employee Overview of Working for AvaTrade

Glassdoor reviews reveal that AvaTrade employees value the teamwork and work-life balance, though there are noted tensions around management and compensation.

| Category | Average Rating |

| Overall rating | 4.2 / 5 (based on 133 reviews) |

| Work-Life balance | Rated around 4.2; praised by parents for flexibility |

| Culture/Team | Friendly, supportive colleagues, inclusive environment |

| Management Salary | Concerns over poor management, low pay, outdated tech |

AvaTrade seems to foster a collaborative environment, but improvements could be made in leadership and internal infrastructure.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in multiple top jurisdictions | Fixed spreads may not suit scalpers |

| Offers AvaProtect™ and AvaSocial | No US traders accepted |

| 100% deposit bonus for new clients | Limited crypto range on Islamic accounts |

| Fast withdrawals, no deposit fees | MT4/MT5 customisation could be broader |

| Strong educational suite (AvaAcademy) | Inactivity fees apply after 3 months |

You might also like:

References:

In Conclusion

AvaTrade operates a network of local offices and customer support centers worldwide, offering region-specific services through these branches. The countries where AvaTrade maintains regional offices and provides localized support:

- 🇮🇪 Ireland

- 🇦🇺 Australia

- 🇨🇱 Chile

- 🇲🇾 Malaysia

- 🇮🇹 Italy

- 🇯🇵 Japan

- 🇲🇽 Mexico

- 🇲🇳 Mongolia

- 🇵🇱 Poland

- 🇿🇦 South Africa

- 🇦🇪 United Arab Emirates

AvaTrade’s global approach helps ensure that clients in these countries can access tailored support and services in their local region, backed by regional licensing and regulatory compliance.

Faq

Yes, AvaTrade provides Islamic swap-free accounts tailored for traders who follow Sharia principles. These accounts eliminate overnight interest charges and maintain the same trading conditions as standard accounts, ensuring compliance with Islamic finance rules without compromising on performance or features.

AvaTrade offers flexible leverage depending on the trader’s location and regulatory requirements. For retail clients under stricter regulations, leverage is capped, while professional traders may access higher levels. This structure balances risk management with trading opportunities across forex, CFDs, and other markets.

AvaTrade is highly suitable for beginners thanks to its user-friendly platforms, intuitive mobile app, and extensive educational resources. The broker also offers free demo accounts, risk management tools, and negative balance protection to help new traders build confidence before transitioning to live markets.

Traders at AvaTrade can access a broad range of instruments including forex pairs, global indices, stocks, ETFs, commodities, bonds, and cryptocurrencies. This wide selection allows clients to diversify their portfolios and explore different strategies across multiple asset classes with a single broker.

Yes, AvaTrade provides multilingual customer support available 24/5 to assist traders worldwide. Support is accessible via live chat, email, and phone, with dedicated teams covering regions across Europe, Asia, Africa, and the Middle East to ensure timely and localized assistance.

- Trading with AvaTrade - Immediate Advantages and Disadvantages

- Overview

- Inside AvaTrade - What You Need to Know Before You Trade

- Starting with just 100 USD

- Deposit and Withdrawal

- AvaTrade Key Facts Summary

- Fees, Spreads, and Commission

- Leverage and Margin

- Bonus Offers and Promotions

- AvaTrade VIP Services

- AvaTrade - From Dublin to Dubai

- Safety and Security

- What Makes AvaTrade a Cut Above the Rest?

- AvaProtect™

- Versatile Account Options Explained

- AvaTrade Account Verification Process

- Demo Account

- Trading Platforms and Tools

- Which Markets Can You Trade?

- AvaTrade Trading Instruments

- Educational Resources

- AvaTrade Awards and Recognition

- Partnerships, Rebates, and Affiliate Options

- Global Customer Support

- AvaTrade vs Exness vs FBS - AvaTrade Compared

- Insights from Real Traders

- Who Should Trade with AvaTrade?

- Common Complaints About AvaTrade

- What Everyone’s Asking about AvaTrade

- Customer Reviews and Trust Scores

- Discussions and Forums about AvaTrade

- Employee Overview of Working for AvaTrade

- Pros and Cons

- In Conclusion